Daniele Marinelli, entrepreneur leading DTSocialize, shares with his readers an important initiative in the financial sector. Visa and Fintech District are collaborating to facilitate access to financial solutions.

The role of Visa

Visa, in collaboration with Fintech District, the renowned fintech community in Italy, aims to facilitate and promote the development of accessible financial technologies and solutions. This goal reflects the joint commitment of both entities to contribute to innovation and accessibility in the financial sector. According to Eva Ruiz, Head of Fintech Southern Europe at Visa, the payments sector is constantly evolving, and fintechs are at the forefront of financial innovation.

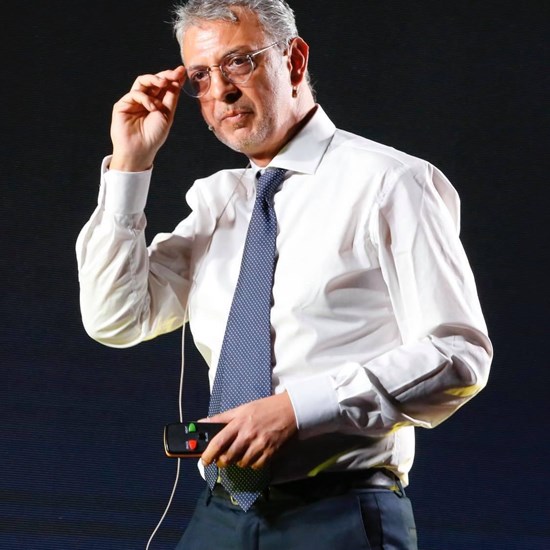

Visa has long been committed to supporting fintechs through programs that foster their growth and an open approach to its global network, providing the technologies and security features that characterize it. The collaboration with Fintech District, explained the owner of the Ushare brand, founder, and CEO of DTSocialize Daniele Marinelli, will allow Visa to further expand its network in Italy, facilitating collaborations with significant entities in the Italian fintech landscape and contributing to the sector’s growth.

The Fintech Partner Connect Program

Daniele Marinelli of DTSocialize Holding explained that the Fintech Partner Connect is a program that offers a suite of functionalities to financial institutions and merchants, combining Visa’s solutions with those of Fintech partners. The project promotes collaboration between the traditional financial sector and fintech startups to develop advanced solutions. Among the existing partnerships, the one with ecolytiq, focused on sustainability, stands out, along with the entry of new players like Switcho, an app for recurring expense analysis.

Furthermore, the “Banking as a Service” program opens up new fintech opportunities, allowing entities outside financial institutions to integrate innovative financial services, such as cards or bank accounts, into their offerings. Eva Ruiz emphasized the broad spectrum of verticals that Visa addresses in the fintech world, including cryptocurrencies, “Buy now pay later”, open banking, and B2B payments, highlighting that Visa’s commitment goes beyond merely issuing payment credentials but also encompasses promoting innovative solutions in payment acceptance.